CNG is considered a viable alternative fuel to reduce carbon emissions in ICVs. Photo:pradeep gaur/mint

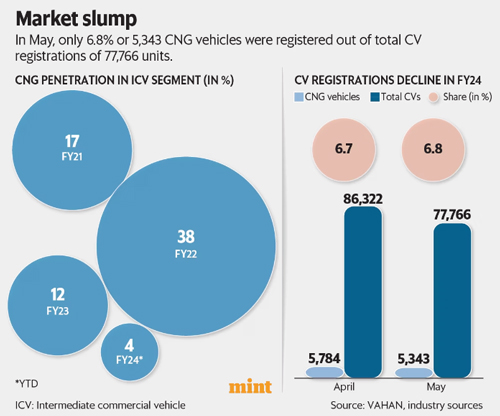

The share of 10-15 tonne trucks that run on compressed natural gas (CNG) has fallen sharply from a peak of 38% at the end of fiscal year 2022, to just 4% in the first two months of the ongoing fiscal, industry data sourced by Mint showed.

The drastic fall in preference for natural gas in the trucking industry— even after a revised gas pricing formula came into effect in April—shows running trucks on CNG is not proving economically viable for fleet operators, who have to offset lower running costs against higher prices of vehicles with new technologies.

At the end of FY23, the share of CNG vehicles in the so-called intermediate commercial vehicle or ICV segment had already come down dramatically to 12%.

Now, sales of ICV trucks running on CNG have fallen to just a quarter of FY23 levels.

CNG is considered a viable alternative fuel to reduce carbon emissions in ICVs. For smaller commercial vehicles, electric vehicles are emerging as a more popular choice than CNG. Commercial vehicle makers are working on accelerating the development of alterative powertrains and fuel options such as ethanol, CNG, LNG, flex fuel, hydrogen and EVs following government regulations for a phased reduction in carbon and particulate matter emissions.

In May, only 6.8% or 5,343 CNG vehicles were registered out of total CV registrations of 77,766 units

However, the penetration of CNG in commercial vehicles in general showed a drop, according to data sourced from the government’s VAHAN portal. These figures show that in May, only 6.8% or 5,343 CNG vehicles were registered out of total CV registrations of 77,766 units. In April, out of the 86,322 CVs registered, only 5,784, or 6.7%, were CNG-fitted.

Dheeraj Hinduja, executive chairman of leading truck maker Ashok Leyland, told Mint, “CNG vehicles have been very prominent in the ICV space, but during the course of the last year due to the benefits of the price differential in CNG getting significantly eroded, the share has come down significantly. And the resale price that you have for diesel is always much better."

“So when you look at the classification of ICVs, there has been a significant reduction on CNG. As an OEM, Ashok Leyland is ready to provide all the alternate fuels for our vehicles, and although at this point of time CNG is not at the forefront like it was possibly more than 12-18 months ago, if the trend does come back and there is this price differential - I think a price differential of 20 to 25% between diesel and CNG, it will really get the market started again for CNG," he added. “But immediately, the inclination seems to be more towards diesel."

In April, the Union cabinet accepted recommendations of the Kirit Parikh Committee, which prescribed a lower ceiling on CNG pricing and indexing to the Indian basket of crude oil imports, effectively lowering the price of natural gas to the range by 7-9%.

“It’s very difficult to predict how the market will go and with fuel prices, even when CNG was at its peak, no one saw the trend changing so quickly again," Hinduja said.

“Therefore, I believe it is very critical and important for us to remain very agile, have the ability to forecast as well as we can with our heads to the ground with our dealers and understand what the customer requirements would be. As soon as the price differential kicks in, I think you know we’ll be able to meet it as per the market requirements. But it’s very difficult to predict as and when that will happen."

Courtesy: Mint, City Air News

|