Synopsis

Shares of Ashok Leyland, a commercial vehicles maker, increased by 4% after the company reported a 5% YoY rise in vehicle sales in June 2023. The company's medium and heavy commercial vehicle sales were up 6% while light commercial vehicle sales increased by 2% YoY. The stock has seen a 14% surge in the last month, and analysts have an average target price of Rs 180. In Q4 FY23, the company's net profit dropped by 17% YoY, but revenue rose by 33%. For FY23, net profit more than doubled, and revenue grew by 67%.

Shares of commercial vehicles maker Ashok Leyland rose 4% to Rs 173.8 in Monday's trade on BSE as the company reported a 5% year-on-year (YoY) jump in total vehicle sales at 15,221 units in June 2023 as compared to 14,531 units sold in June 2022.

Meanwhile, the company's total domestic sales in June stood at 14,363 units, up 7% from 13,469 units sold in the same month last year.

The company's total medium & heavy commercial vehicle (M&HCV) sales increased by 6% YoY to 9,962 units. Total light commercial vehicle (LCV) sales were higher by 2% YoY at 5,259 units during the period under review.

At 10.04 am, the scrip was trading 2% higher at Rs 170.6 on BSE. In the last one month, the stock has surged over 14%, while it has risen over 17% in the past one year.

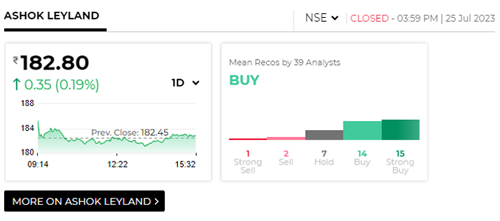

As per Trendlyne data, the average target price of the stock is Rs 180, which indicates an upside potential of 6% from the current market price. The consensus recommendation from 38 analysts for the stock is a 'Buy'.

Technically, the stock's day RSI (14) is at 70.4. The RSI below 30 is considered oversold, and above 70 is overbought, Trendlyne data showed. MACD is at 4.2, which is above its center and signal Line, this is a bullish indicator.

In Q4 FY23, Ashok Leyland reported a nearly 17% YoY drop in net profit to Rs 751.41 crore, despite a rise in revenue. The total revenue from operations increased nearly 33% YoY to Rs 11,626 crore in Q4 FY23.

For FY23, the net profit of the company surged more than twofold to Rs 1,380 crore, and revenue grew 67% to Rs 35,977 crore.

Operating profit, calculated as earnings before interest, taxes, depreciation and amortization (EBITDA), rose to Rs 1,276 crore in the March quarter from Rs 776.1 crore a year ago. Operating margins expanded 209 basis points on year to 10.97%.

Courtesy: ET

|