|

A matter of cost

Says Dr RK Malhotra, President, National Hydrogen Association (NHA), “Manufacturing green hydrogen is dependent on renewable energy sources. Wind and solar energy is used in the electrolysis process to separate the hydrogen and oxygen from water (H2O). Electrolysers are costly equipment and have to be imported as there are very few manufacturers of this specialised equipment in India. All these factors play a big role in determining the final cost of green hydrogen.” Although the government has announced its support for waiving the transmission charges and allowing the banking of green power, there are still issues of inter-state taxes and accounting for transmission losses, among others, that need to be fixed. He pointed out that the government needs to support the industry by providing production linked incentives (PLI) benefits for electrolyser manufacturing, and R&D support for improving the technology and efficiency of electrolysers. "Industry needs to also invest in developing or acquiring the best innovative and efficient technologies and plan for capacities to have economies of scale. Despite best efforts, the cost of green hydrogen may come down to around US$ 2.5 to US$ 3.0 per kg by 2030. Though many have announced a target of US$ 1 per kg, even the price of US$2 per kg will be quite attractive for the hydrogen market to grow fast," said Malhotra, who earlier worked as R&D head and CMD of Indian Oil Corporation (IOCL).

Cummins designed B6.7H hydrogen powered ICE engine offers up to 290 hp (216 kW) output and 1,200 Nm peak torque and is suited for commercial vehicles.

Says Dr N Saravanan, President and Chief Technology Officer of commercial vehicle maker Ashok Leyland, “The situation is still some distance away from reaching a tipping point, even though the government is strongly supporting the move towards hydrogen mobility, with all the right policies and businesses are eager to get into hydrogen and its related infrastructure. While OEMs work on developing the technologies from the production side, they will be accelerated once there is more proof on the ground, such as investments, the production of green hydrogen at a commercial scale, and setting up of refuelling stations.”

“Therefore, while it is a wait-and-watch situation, one could expect to see some investments in the next few months. That could be the point of inflection and propel us in the direction of finding measures to accelerate development of such vehicles to offer options to the end consumer,” Dr Saravanan explained.

The CTO added that the second-most-significant factor would be how the economics would work out. It must not only be the hydrogen production and related infrastructure, but also the expense to the final customer per kilogramme. “That will be important," Dr Saravanan added.

Different types of hydrogen

As of now, only a handful of Indian companies are involved in making hydrogen for mostly industrial applications. Most of India's hydrogen output is categorised as ‘grey hydrogen’ which is produced from natural gas or methane, with carbon dioxide as a by-product. Reliance Industries is one of the largest producers of grey hydrogen for industrial applications.

Secondly, red hydrogen is hydrogen that is produced as a result of a highly-complicated thermo chemical reaction that involves the high-temperature catalytic splitting of water with iodine and sulphur at a high temperature (usually around 900° C). Thermal energy of this calibre is usually available from a nuclear reactor. On the other hand, blue hydrogen is also extracted using the steam reforming process, but it differs from grey hydrogen in the sense that the carbon emissions released are captured and stored. Blue hydrogen is also sometimes christened ‘low-carbon hydrogen’ as the production process does not avoid the creation of greenhouse gases. Similarly, white hydrogen is extracted through a process called fracking that involves drilling into the earth.

The best option out of all for mobility applications is green hydrogen, which does not generate any emissions in its entire life cycle as it uses renewable energy in the production process. It is made by electrolysing or splitting water molecules using clean electricity created from surplus renewable energy from wind or solar power systems. No carbon emissions are released in the process.

While it is a strong alternative to grey or blue hydrogen, for now the main challenge is in reducing the production costs for practical reasons.

Investing in green hydrogen infrastructure

Industry experts say unless we move on from vehicle architecture to developing the green hydrogen infrastructure, it's highly unlikely that green hydrogen as a fuel will take off in the medium- or long-term.

Besides water, other known sources of hydrogen include natural gas, bio-hydrogen, ethanol, biofuels, methane, gas from biomass and fossil fuels. Pramod Choudhary Executive Chairman of alternative fuels biotechnology major, Pune-based Praj Industries says, "Upstream challenges in green hydrogen production, midstream challenges in storage and transportation, and downstream challenges of a hydrogen-based component ecosystem will take time for the green hydrogen ecosystem to develop, which in the case of biofuels is already well developed."

Nitin Seth, Chief Executive Officer, New Mobility, Reliance Industries, admitted that getting 50 billion litres of water is truly challenging and India can turn to SWROs (Saline water reverse osmosis plants) to get India’s source of pure demineralised water required for electrolysis.

Investments from the private sector are also looking up. From a consumer's perspective, Seth has highlighted that hydrogen will work for trucks and buses for intra-city and inter-city applications when their daily run is above 200 kms. To start with, hydrogen with fuel dispensing stations ready for refuelling in every 200 km range are required every 200 kms on main highways. India currently has only two hydrogen pumps, one at Indian Oil's R&D Centre in Faridabad and the other at the National Institute of Solar Energy in Gurugram. Reliance Industries will be India's first private sector firm to launch a hydrogen dispensation station in Jamnagar in the first week of April 2023.

Hydrogen versus other fuels

Comparing the hydrogen ICE technology with the conventional fuels, Seth said: “Hydrogen has an edge over other fuels like diesel or CNG as it is three times more efficient than these fuels. Hence the price of hydrogen has to be closer to Rs 250 (vis a vis Diesel at Rs 92 , CNG at Rs 84) and if that is achieved, then hydrogen as a fuel can be very popular and save lot of foreign exchange for the country.” Furthermore, he said that India needs to invest in more hydrogen dispensing stations across the highways.

Storage and transportation

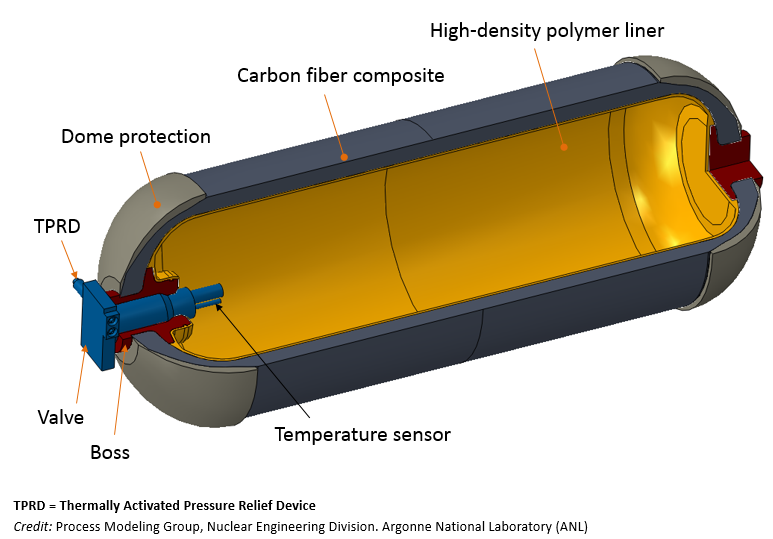

Hydrogen storage tanks have to comply with a complex set of specifications to be safe and secure for static or transportation.

As a gas, hydrogen is difficult to store under normal conditions and it requires specialised technologies and applications. Seth says specialised tanks (350 Bar and 700 Bar) are required for on board (vehicle) and pump storage for gaseous hydrogen. The raw material for these carbon fibre tanks is not yet manufactured in India and has to be imported. Importing carbon fibre raw material is very costly and will make it more expensive than other traditional fuel vehicles.

These type of storage systems are not made in India and as of now, they also have to be imported. The same is with electrolysers, which makes the technology very expensive as carbon fibre tanks have to be loaded on the vehicle itself.

Reliance’s Dhirubhai Ambani Green Energy Giga Complex, that is spread over 5,000 acres in Jamnagar is among the world's largest integrated renewable energy manufacturing facilities with an investment of Rs 75,000 crore in the next three to five years. As the country is in the early stages, it does not have any regulatory framework currently in place for the transportation of hydrogen. Hydrogen projects in the domestic market should be made aware of the technical and safety aspects of storage and transportation of the fuel.

Outlook

If India is meet its zero carbon neutral targets by 2070, all sectors (automotive and non-automotive) will require building up the resources and infrastructure. This is where investment and participation of both government and private sector is vital to ensure the mission is successful. It's becoming obvious that building a hydrogen-based ecosystem is not an overnight process and it has to be done step by step.

Storage of H2 requires high-pressure tanks (350–700 bar) and for H2 as a liquid requires cryogenic temperatures because the boiling point of H2 at one atmosphere pressure is -252.8°C.

The big question is whether hydrogen alone can solve all the emission problems.

As of now, there's a big debate all over the world and opinions are varied. Germany and the rest of the European Union have just announced that they have reached an agreement in the dispute over the future of cars with ICE. They will now allow the registration of new passenger vehicles with such engines after 2035 provided they use climate-neutral 'e-fuels' only. In April, the European Parliament approved a law to effectively ban the sale of any new car with a combustion engine including petrol, diesel and hybrid models in the European Union from 2035.

It seems that cleaner fuels — hydrogen or biofuels like ethanol will hold the key for the future energy applications and more. This is just the beginning.

Courtesy: Auto Car Pro

|