|

The government companies too are leading from the front. The Gas Authority of India (GAIL) — the country's largest natural gas refining and handling company plans to build India's largest green hydrogen plant and has already started mixing hydrogen into natural gas in one of the cities on a pilot basis.

Similarly, the National Thermal Power Corporation (NTPC), the country's largest power utility company, has drawn up plans to produce green hydrogen on a commercial scale. Its pilot project is making the gas, which is estimated to cost in the range of US$ 2.8-3 per kilogramme. Furthermore, Indian Oil recently announced its plans to build a green hydrogen plant at its Mathura refinery in Uttar Pradesh and will use electrolyser-based processes to create the gas.

According to PK Banerjee, Executive Director of the Society of Indian Automobile Manufacturers (SIAM) and Convener of the Government of India's Mobility M3 Group on Renewable Energy on Hydrogen: "The pace at which we are progressing, we are much faster than most global economies.” Banerjee goes on to say that the Ministry of Renewable Energy is looking into every possible application for hydrogen, including two-wheelers, three-wheelers, public transit systems, rail locomotives, and even the construction equipment sector, which could be powered by hydrogen in the future. “SIAM, along with the government, is looking at every aspect of the hydrogen economy and has submitted a report to the Renewable Energy Ministry stating the interventions required for each industry constituent to scale up,” Banerjee said.

The news comes months after the National Green Hydrogen Mission was created in January. The mission was promoted as providing numerous benefits, including the creation of export opportunities for green hydrogen and its derivatives, the decarbonisation of the industrial, mobility, and energy sectors, the reduction of reliance on imported fossil fuels and feedstock, the development of indigenous manufacturing capabilities, cutting-edge technologies, and creation of job opportunities.

Green hydrogen target and policies

India will need 125 GW of renewable energy capacity- to produce 5 MMTPA green hydrogen. The targets are anticipated to draw over Rs 8 lakh crore in investments and create over six lakh jobs by 2030, when the government also forecasts that the country will be able to avoid emitting nearly 50 MMT of CO2 into the atmosphere.

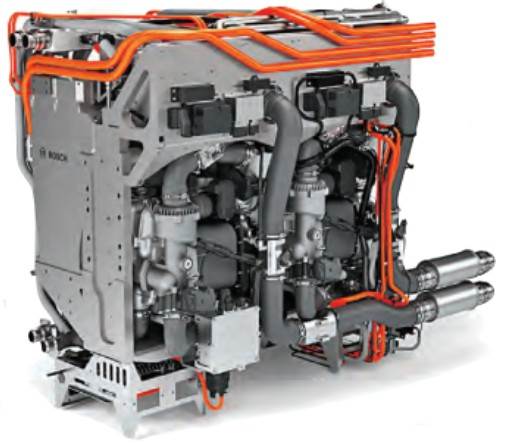

Besides use in ICE, hydrogen can also be used to create electricity in Fuel Cell type of applications in EVs.

The initiative, the government said, will facilitate the generation of demand for the production, use, and export of green hydrogen. The Strategic Interventions for Green Hydrogen Transition Programme or SIGHT will offer two distinct financial incentives targeted at domestic electrolyser manufacturing and green hydrogen production. In addition, the mission will finance pilot projects in emerging end-use sectors and manufacturing pathways. Green hydrogen hubs will be discovered and established in areas with large-scale hydrogen production and or utilisation capabilities. An enabling policy framework will be developed to aid in the creation of a green hydrogen ecosystem.

Electrolysers is key

- A kilogramme of green hydrogen can be produced by electrolysis using nine litres of water and energy.

- Global electrolyser manufacturing capacity reached almost 8GW per year in 2021.

- Europe and China account for 80 percent of global manufacturing capacity of electrolysers.

- Electrolyser investment costs are difficult to compare across systems as often there is a lack of information about key system parameters.

Rajendra Petkar, President and Chief Technology Officer, Tata Motors, stated that while India has vowed to be carbon neutral by 2070, recent government announcements have laid out a clear framework for the use of green hydrogen. Petkar went on to say that hydrogen, which was once thought to be a distant future, is rapidly approaching reality. "There is only one direction, that is to embrace green hydrogen technology,” Petkar added. At the AutoExpo 2023 in New Delhi, Tata Motors had showcased its Starbus Fuel Cell EV which is claimed to be India's first hydrogen fuel-cell bus for commercial use. The PRIMA E.55S and PRIMA H.55S concepts, which are hydrogen fuel-cell driven tractors and hydrogen ICE powered concept cars, respectively, were also on display for technology demonstration by the Indian automaker.

Hype aside, massive challenges remain

With all these grand plans, India will have to address numerous challenges along the way. The main reasons for the lack of mass-scale adoption of green hydrogen in India include water and land availability, capital intensiveness, policy challenges, and technology dynamics, amongst others. For instance, a kilogramme of green hydrogen can be produced by electrolysis using nine litres of water and energy, implying India will need approximately 50 billion litres of demineralised water supply to execute the national hydrogen mission. Secondly, a lot of land will be required for establishing renewable energy plants.

Furthermore, the production of hydrogen from renewable sources is an energy-intensive process that should always be avoided whenever feasible. This is because hydrogen produced by consuming 10 units of electricity only yields seven units of equivalent energy as 3 units are lost towards the compression and transportation of the fuel. As a result, using electricity directly to power vehicles, rather than converting it to hydrogen is considered by experts as a more energy efficient process.

Another area that needs to be factored in is whether the automotive industry should use green power to create hydrogen while still using coal to generate energy. The life cycle emissions of coal-based power as compared to hydrogen produced from coal gasification, may need to be calculated. Making green hydrogen mandatory in refineries will increase the cost of finished products because green hydrogen is more expensive than regular hydrogen currently being generated from steam methane reforming (SMR). As is being talked about, requiring implementation in the fertiliser sector will add to the cost of subsidies, according to industry stakeholders.

|