SynopsisIndusInd Bank's market capitalisation crossed Rs 1 lakh crore, its highest in three years, as its shares hit a 52-week high of Rs 1,295. The bank's stock has rallied approximately 44% over the past year. It is the sixth Indian bank to be valued at over Rs 1 lakh crore. IndusInd Bank has seen improvements in its return on equity and return on assets over the past two years, with a consistently growing quarterly net profit and profit margin YoY.

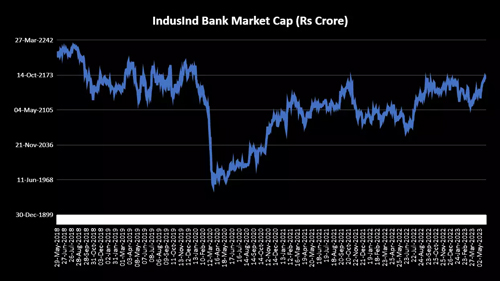

Shares of private sector lender IndusInd Bank on Monday hit a fresh 52-week high of Rs 1,295 with the Nifty counter's market capitalisation crossing the Rs 1 lakh crore mark for the first time after three years.

The stock had previously closed over the Rs 1 lakh crore mark in January 2020 and then during the Covid-led market crash, its market value slipped below Rs 20,889 crore on March 25, 2020.

In the last one year, IndusInd Bank shares have rallied around 44%. An average of brokerage estimates shows that the stock can rally up to Rs 1.442, which signals an upside potential of up to 12% in the next 12 months.

The consensus recommendation of 37 analysts for IndusInd Bank is buy with none of the experts giving sell recommendations, shows Trendlyne data.

While HDFC Bank, with a market cap of over Rs 9.15 lakh crore, is India's most valued bank, IndusInd is the sixth one to enter the coveted Rs 1 lakh crore club.

Trendlyne data suggests several factors have contributed to the bank's renewed strength. Firstly, IndusInd Bank has been experiencing improvements in its return on equity (ROE) and return on assets (ROA) over the past two years. Additionally, there has been consistent growth in its quarterly net profit, accompanied by an increasing profit margin year over year.

In the March quarter, the private bank had posted a 50% YoY rise in its net profit at Rs 2,040 crore.

Of the 33 analysts who reviewed the bank's quarterly earnings, 28 maintained their 'buy' or 'overweight' ratings and five remained neutral, Bloomberg data showed. Nine raised price targets and eight slashed them. The remaining 16 analysts maintained their price targets on the stock.

Goldman Sachs raised its price target to Rs 1,522 after Q4 results while Jefferies maintained the status quo at Rs 1,550.

Courtesy: ET |