The private sector lender IndusInd Bank has hiked its interest rates on fixed deposits of less than ₹2 Cr.

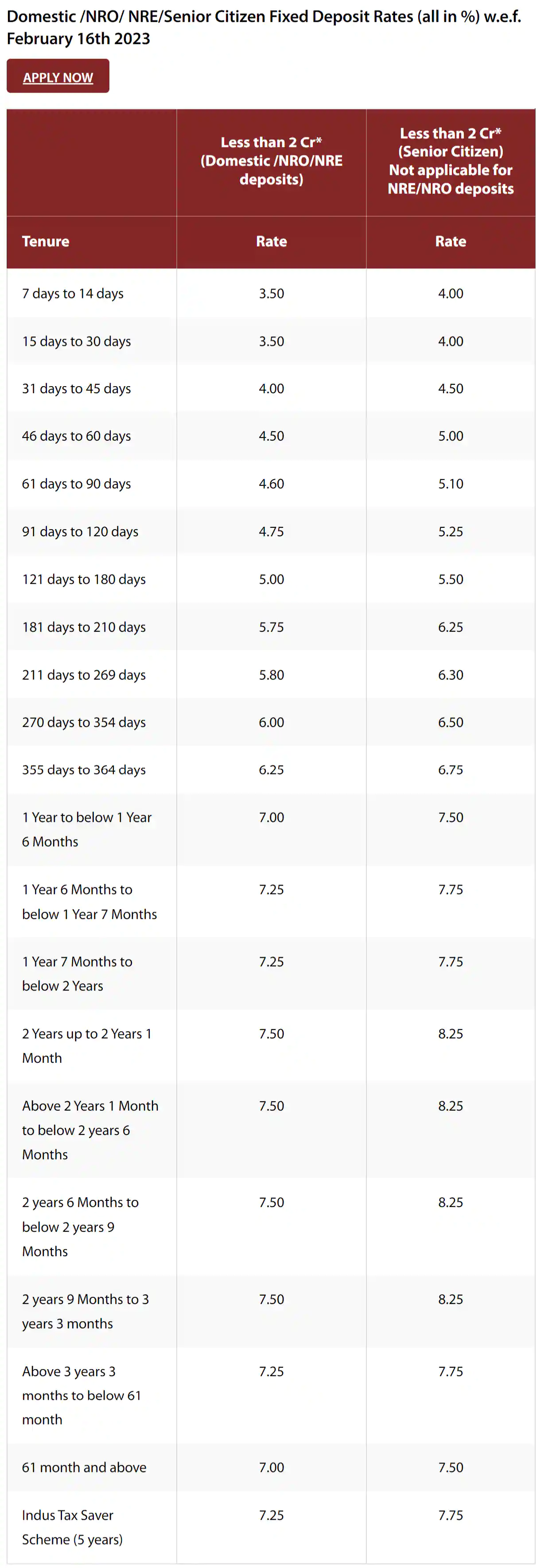

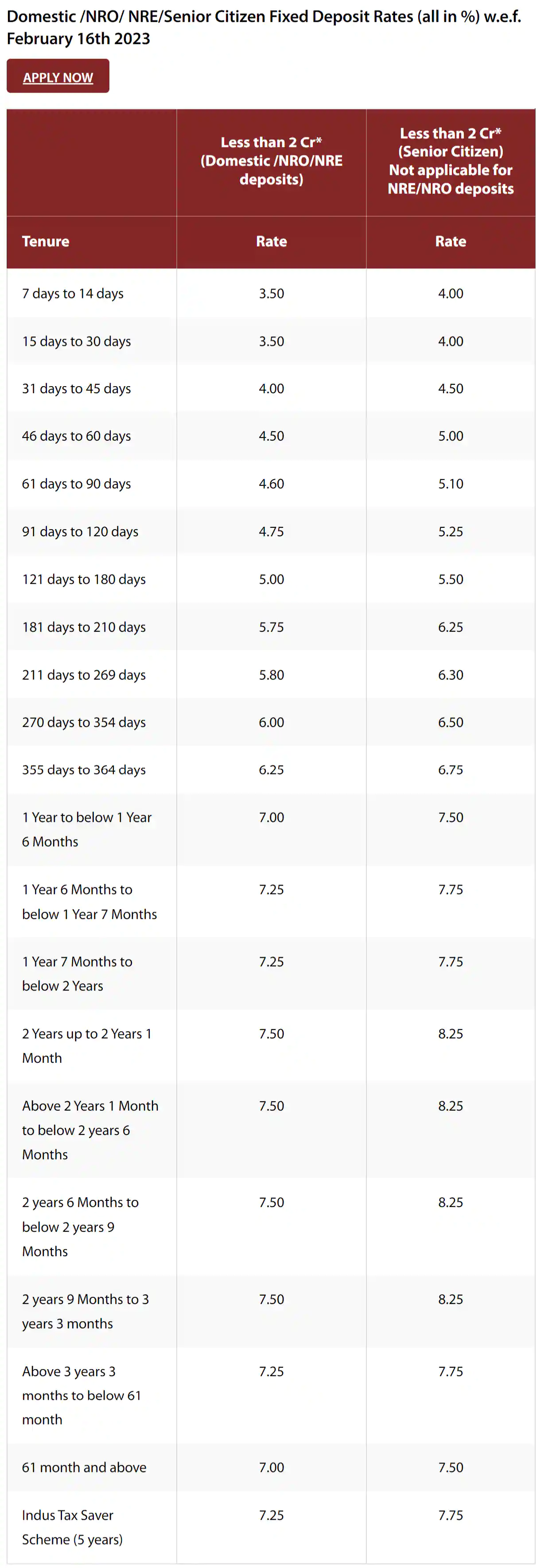

The private sector lender IndusInd Bank has hiked its interest rates on fixed deposits of less than ₹2 Cr. The bank is currently providing an interest rate ranging from 3.505 to 7% for the general public and 4.00% to 7.50% for senior persons on a deposit tenor running from 7 days to 61 months and above. IndusInd Bank is now providing a maximum return of 7.50% for non-senior citizens and 8.25% for senior citizens on a deposit tenor of 2 years up to 3 years and 3 months. The latest fixed deposit interest rates are in effect as of today, February 16, 2023, according to the bank's official website.

IndusInd Bank FD Rates

The bank is currently giving an interest rate of 3.50% on fixed deposits that mature in the next 7 days to 30 days, and an interest rate of 4.00% on those that mature in the next 31 days to 45 days, according to IndusInd Bank. The interest rates offered by IndusInd Bank are now 4.50% for deposits held for 46 days to 60 days and 4.60% for deposits held for 61 days to 90 days.

Deposits maturing between 91 and 120 days from now on will earn interest at a rate of 4.75%, while deposits maturing between 121 and 180 days from now on will earn interest at a rate of 5.00%. The bank is currently giving an interest rate of 5.75% on fixed deposits that mature in 181 days to 210 days, and IndusInd Bank is now guaranteeing an interest rate of 5.80% on deposits that mature in 211 days to 269 days. A deposit tenor of 270 days to 354 days will now earn an interest rate of 6.00% from IndusInd Bank, while a deposit tenor of 355 days to 364 days will earn an interest rate of 6.25%.

Deposits with maturities between 1 year and 1 year and 6 months and below will now earn interest at a rate of 7%, while deposits with maturities between 1 year and 6 months and below 2 years will now earn interest at a rate of 7.25%. The bank will now offer a maximum return of 7.50% on fixed deposits maturing in 2 years to less than 3 years, 3 months, and will now offer a rate of 7.25% on deposits maturing in 3 years to more but less than 61 months. Deposits maturing in 61 months and longer will now earn an interest rate of 7.00%, and the bank will also give a 7.25% interest rate on deposits made under the Indus Tax Saver Scheme (5 years).

Click to enlarge

Regarding additional interest rates on domestic term deposits for senior citizens, IndusInd Bank has mentioned on its website that “Please note the additional 0.75% over and above card rates applicable for Term Deposits of Senior Citizens (age 60 years and above) for value below ₹5 Cr (Callable) and tenor greater than 2 Yrs upto 3 Yrs & 3 months (Not applicable for NRO/NRE Deposits). For rest tenors, the additional benefit is 0.50% over and above card rates."

“In the event of Premature withdrawal before the specified tenure, the offered interest rate applicable will be the interest rate corresponding to the amount based slab (withdrawn amount) and basis the actual run period (tenure). Additionally, penal interest of 1% shall be levied on the premature withdrawal, if applicable," said IndusInd Bank on its website.

When compared to other leading private banks in India, IndusInd Bank provides the highest fixed deposit interest rates. You may book an FD of any amount instantaneously by submitting your Aadhar and PAN and promptly completing video KYC. Customers have the option of choosing between monthly, quarterly, half-annual, yearly, or at-maturity interest payments, and both normal and senior citizens' accounts feature attractive interest rates.

“With AA+ Crisil and ICRA rating, IndusInd bank is one of the safest banks for opening fixed deposits. Investors can choose between flexible tenures ranging from 7 days to 10 years according to their needs and deposit capacity. The deposit insurance scheme of RBI covers all IndusInd Bank deposits of up to INR 5,00,000 at customer level. Contact IndusInd Bank or visit their website to open an FD account online and earn the best-in-class interest rate," said IndusInd Bank on its website.

Courtesy: Mint |